Monitor and invest in biodiversity, water, soil and carbon along your supply chain.

Landler™ is the first natural capital management platform that allows you to take control over your ecosystem risk.

The first platform to monitor and invest in nature

Secure supply and business continuity

Engage suppliers to incentivise regenerative land-use practices

Use performance based contracts to increase supply chain resilience and to mitigate yield loss and volatility

Reduce scope 3 emissions

Store carbon and reduce emissions with industry best practices

Use performance-based contracts to finance and purchase these carbon removals and reductions

Assume leadership in the nature-positive movement

Claim positive impact on nature without fear of greenwashing, by using an outcome-based system

Improve the health of your land and protect your yield for the long-term.

Book all investments into supply chain as assets on the balance sheet, transforming their cost profile

Best-in-class technology and science

Our AI-based measurement, reporting and verification (MRV) models, fed by geospatial and ground data, measure the biophysical aspects across carbon, water and biodiversity.

Measure and track natural capital

Our AI-based MRV, fed by geospatial data and ground data, measures the status of natural capital in supply chains - across carbon, water, biodiversity and soil. We monitor continuously, allowing businesses to track the impact of regenerative practices over time.

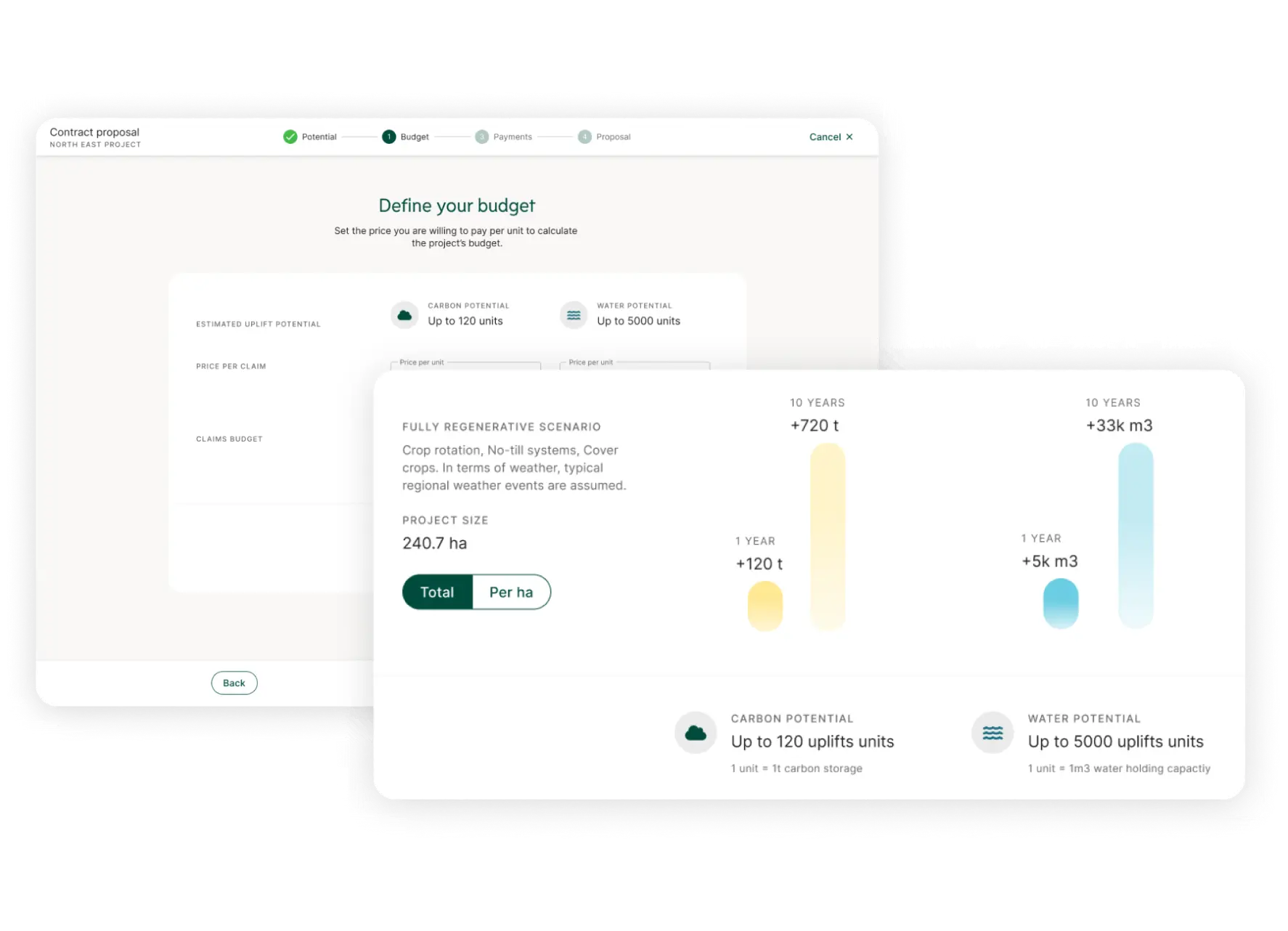

Invest in your supply chain

View the natural capital accounts of suppliers and propose investments to help them switch to regenerative practices. Our MRV enables continuous tracking of investment performance. Using Landler, businesses now book these investments as assets on their balance sheets, instead of expenses in their P&L.

It's easy to get started.

Landler is an easy-to-use platform that allows you to track the impact of nature positive practices. From onboarding to signing Nature Equity agreements, our team here to help every step of the way.

you are in good company

Leading companies use Landler to become nature-positive.

Landler in action

Begin your journey today.